GateUser-aa7df71e

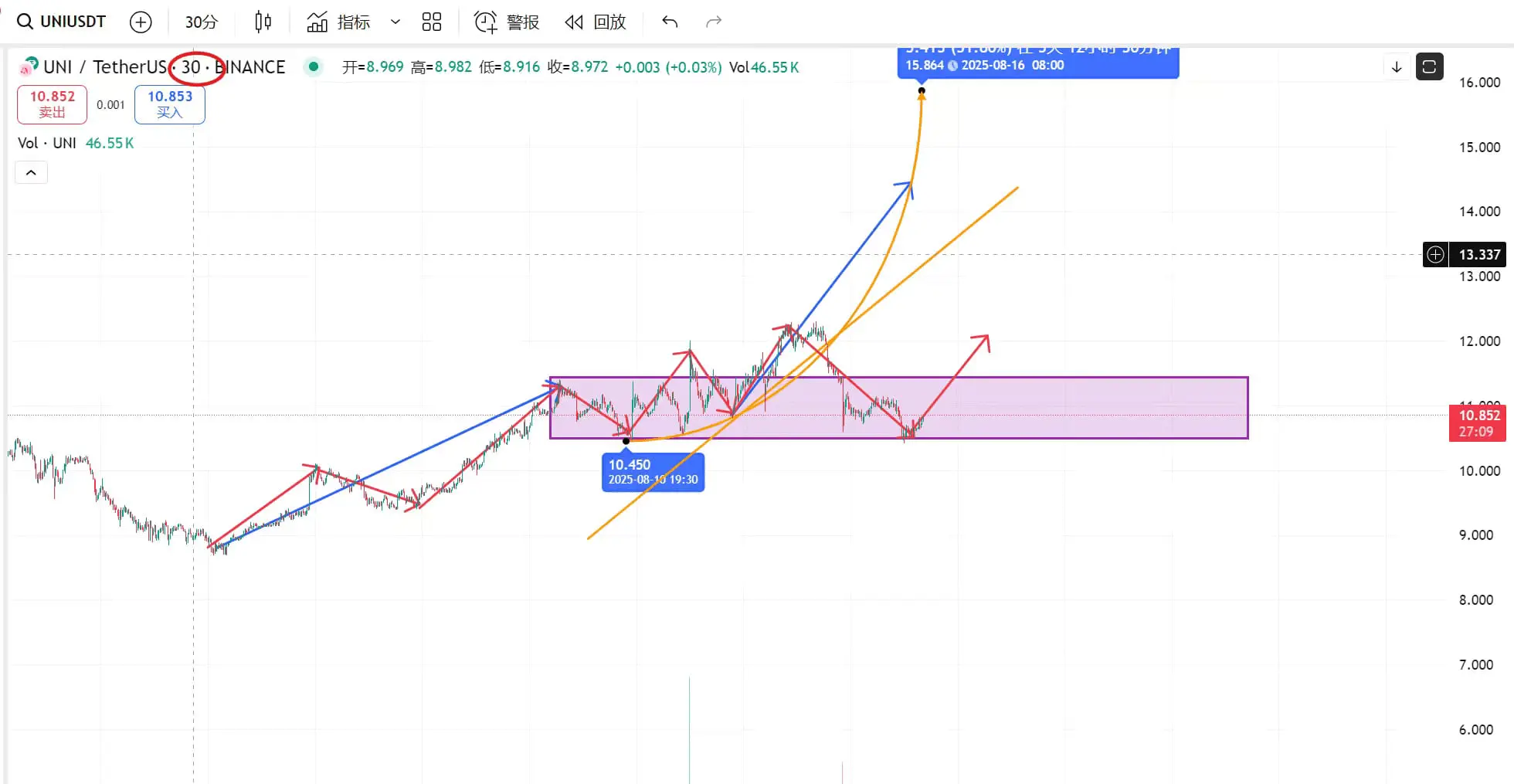

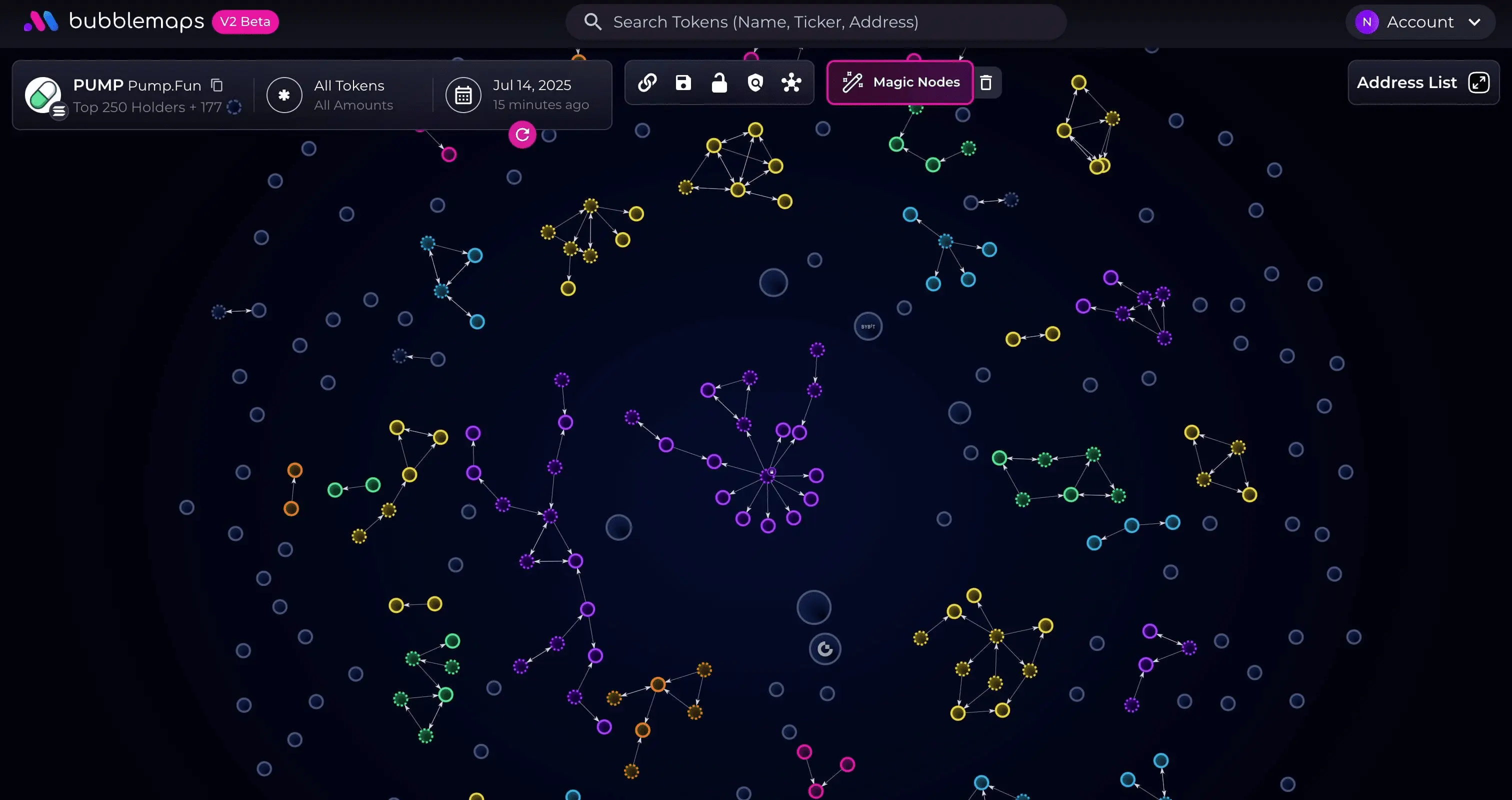

In the game of the Crypto Assets market, market makers usually adopt a series of strategies to control market direction, which often poses challenges for ordinary investors. Understanding these strategies is crucial for investors as it can help them make more informed decisions.

Market makers usually employ three main strategies to influence the market:

1. Patience Consumption Strategy:

This strategy mainly creates the illusion of a long-term sideways market by controlling the price fluctuations within a small range for an extended period. Prices may fluctuate up and down within a very narrow

View OriginalMarket makers usually employ three main strategies to influence the market:

1. Patience Consumption Strategy:

This strategy mainly creates the illusion of a long-term sideways market by controlling the price fluctuations within a small range for an extended period. Prices may fluctuate up and down within a very narrow